One System, One Flow - Payroll Integration into Odoo

Our Odoo payroll integration solution simplifies payroll tasks for you by

centralising payroll within the Odoo ecosystem. Instead of managing payroll in

isolation, you gain a connected workflow where HR, accounting, compliance, and

employee data come standard — reducing admin load while keeping every ATO

requirement in check.

Unlike generic connectors, our solution addresses local regulations and real

business workflows for Australian businesses.

What is Odoo Payroll Integration?

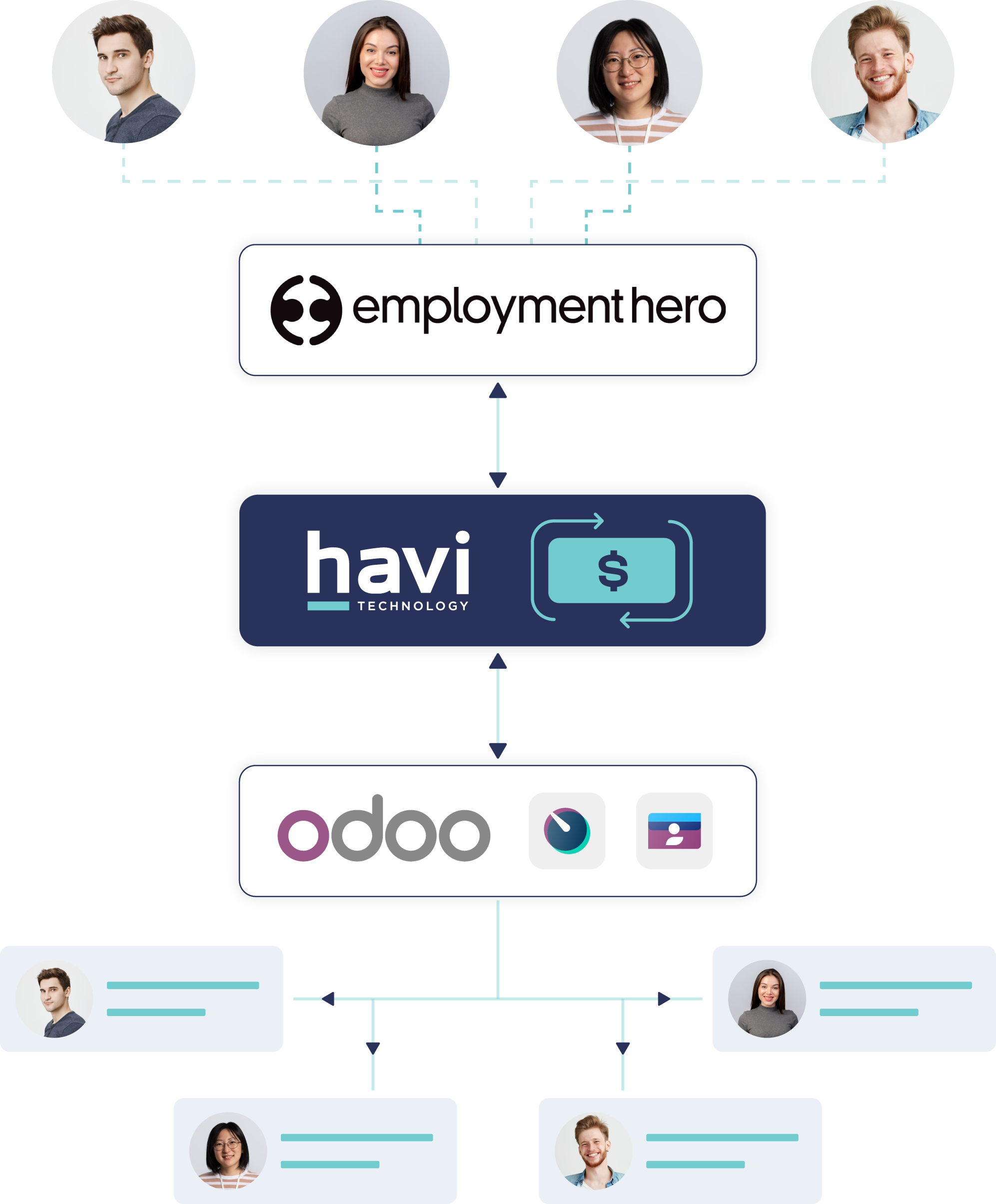

Odoo Payroll integration connects your payroll platform such as Employment Hero

(KeyPay) with Odoo ERP – enabling automated payslips, leave management,

superanuation contributions, and Single Touch Payroll (STP) reporting in one

system.

Note:

KeyPay was rebranded as Employment Hero in March 2023.

As an official Odoo Partner in Australia, we deliver tailored payroll

integrations that are fully aligned with Australian regulations and work for

your team, your industry, and your future growth.

With Havi’s Odoo Payroll integration, your business gains a compliant, scalable,

and cost-efficient payroll system — purpose-built for Australia’s needs.

What is Odoo Payroll Integration?

Odoo Payroll integration connects your payroll platform such as Employment Hero

(KeyPay) with Odoo ERP – enabling automated payslips, leave management,

superanuation contributions, and Single Touch Payroll (STP) reporting in one

system.

Note:

KeyPay was rebranded as Employment Hero in March 2023.

As an official Odoo Partner in Australia, we deliver tailored payroll

integration that are fully aligned with Australian regulations and works for

your team, your industry, and your future growth.

With Havi’s Odoo Payroll integration, your business gains a compliant, scalable,

and cost-efficient payroll system — purpose-built for Australia’s needs.

Odoo Payroll Integration - Automated, Compliant, and Unified

Boost Accuracy

Real-time integration between Employment Hero (KeyPay) and Odoo removes double entry and manual processing, while reducing the potential for human error.

End-to-End STP Compliance

Employment Hero (KeyPay) handles STP submissions to the ATO. Our integration ensures that payroll data is structured correctly within Odoo for consistent, compliant reporting.

A Unified Business System

Manage payroll in Employment Hero (KeyPay) while running the rest of your business in Odoo. With apps for HR, Finance, Sales, Inventory, etc, your team works from a single source of truth.

Key Features of Odoo Payroll Integration for Australian Compliance

Simple Configuration

Easily configure payroll accounts, STP mappings, leave policies, and superannuation rules — all aligned with ATO requirements, modern award structures, and multi-site workforce needs.

Real-Time Data Sync

Payroll data processed in Employment Hero (KeyPay) flows directly into Odoo. Journal entries are created automatically in Odoo’s Accounting - reducing double entry and human error.

Scheduled Payroll Actions

Automate repetitive payroll tasks such as pay runs, leave approvals, and payslip generation based on your schedule to save time and reduce manual effort.

Data Security

Our integration includes enterprise-grade cybersecurity measures — ensuring payroll data transfers between Employment Hero (KeyPay) and Odoo remain secure, encrypted, and auditable.

Why Choose Havi for Your Odoo Payroll Integration?

We Deliver it First

We’ve delivered successful Odoo – Employment Hero (KeyPay) integration for Australian clients before the built-in module existed. We know what works — and what doesn’t.

Built for Australian Payroll

Our solution is tailored to Australian payroll needs, from awards compliance to superannuation — backed by deep local knowledge.

Full-supported Implementation

We collaborate with your team — providing guidance during setup, training, and staying available for ongoing support, upgrades, or ATO changes.

Certified, Local Expertise

As an ISO 9001-certified Odoo Partner based in Australia, we combine technical skills with local business insight to deliver real results.

How We Guide You Through Your Payroll Integration Journey

Understand Your Needs

Tailored Solution Design

Integration & Testing

Training & Go-live

On-going Support & Evolve

Odoo Payroll Integration in Australia:

What Businesses Ask Us Most

1. Can I use Employment Hero (KeyPay) with Odoo even if Odoo has built-in payroll?

2. What is STP Phase 2, and why is it critical for Australian payroll integrations?

3. Which Odoo apps are most critical for Australian payroll automation, and how do they support STP?

Let’s Make Payroll Easier — Together

Call or email us to discuss how to make your business simpler, faster and more efficient. Free demonstrations available upon request.